What distinction can be seen in the cost profile of your Planet Positive products, be it from the composition of a mix of labor vs. raw materials, supply-chain locations, or the R&D amortization from new technologies?

In terms of production costs, the Planet Positive portfolio is a good cross-section of the overall product portfolio so there should be no major differences. In terms of R&D, we look to grow the Planet Positive portfolio and R&D is focused on Planet Positive projects. Because we think new Planet Positive products are likely to be received favorably in the market, we would expect to be able to recover R&D costs at least in line with returns on the broader portfolio.

Can you point to any instances where design specifications that include your Planet Positive offering have supported customers’ ability to receive permit approvals either on brownfield or greenfield investments?

We would point out that there has been relatively few major copper discoveries i.e. finding it even before you get to permitting is a challenge. Probably the best concrete example of how Planet Positive can help is when a customer used Planet Positive as part of an application for project financing, and this helped provide the banks with the ESG credentials needed. More generally, Planet Positive products helping to reduce the footprint of projects (e.g. tailings/water usage) should help with permit approval, but in addition many other factors also go into these approval processes.

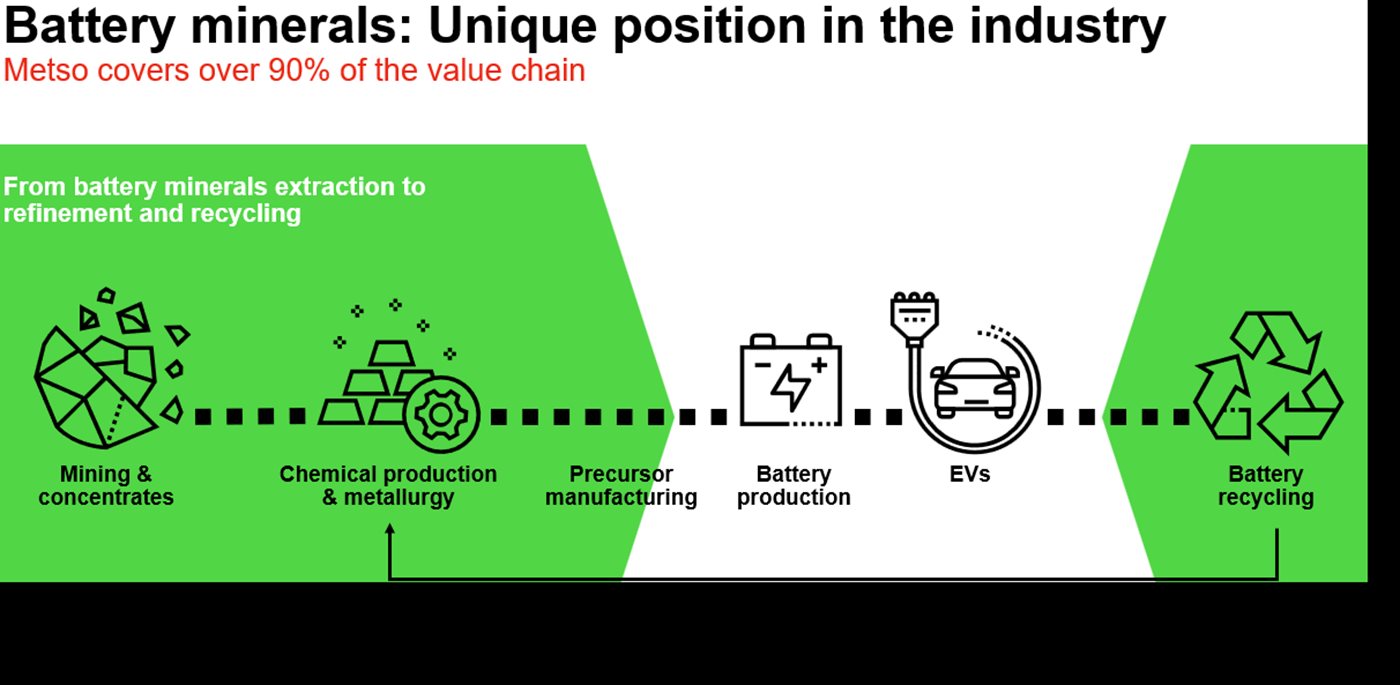

Can you talk about your battery minerals commercial growth strategy concerning your product offering and route-to-market?

We envisage growth in battery minerals, and high odds of real supply shortages in battery metals such as copper, nickel, etc. Our product strategy is to ensure a comprehensive offering across full, and often complex, flowsheets for battery minerals producers, and a capacity to support in growth locations – e.g. South America. We also recognize that given the need for rapid growth and difficult projects, i.e. technically challenging, small scale or lower grade, smaller customers in particular may need more technical support.